Table Of Contents

Have you ever heard of Jesse Livermore?

He was the man who turned trading into an art form. A true master of Wall Street, his life and career were as volatile as the stocks he traded.

His story is a rollercoaster ride through booming markets and devastating crashes. It’s one filled with million-dollar triumphs, heartbreaking losses, and everything in between. And despite all its ups and downs, or perhaps because of them, it’s completely fascinating.

If you’ve ever dreamed about making big money on Wall Street, then this story will capture your imagination like no other.

Ready to explore the history of Wall Street’s legendary traders? We’re going back to the era when big shots like Livermore were kings of Wall Street.

The Early Life and Start of Jesse Livermore’s Trading Career

Born in 1877, Jesse Livermore was not your average kid. His passion for numbers gave him the chance to start trading at the early age of 15.

He earned the nickname “The Boy Plunger”, referring to his young age and bold attitude when it came to trading stocks.

Jesse’s fascination with markets began when he started working at Paine Webber.

There he developed an affinity towards price movements. It wasn’t long before Jesse made his first trade – one which marked the start of an illustrious career as a stock operator. The stock that he bought was from a company called Burlington and from that single trade, he made a $3.12 profit.

After accumulating $10 000 ($300 000 adjusted with the inflation today) by trading in bucket shops Jesse decided that he had to go to the big league. The only logical choice was to go to New York City’s bustling financial scene.

Jesse Livermore had no previous knowledge in this field. But his passion for trading made him start developing what would become known as the “Livermore System”.

Livermore believed in following market trends rather than relying on insider tips or news events. These principles are followed by many successful traders even now.

This allowed him to make calculated risks based on factual data instead of mere speculation. Remember this quote by Jesse: “It never was my thinking that made big money for me.”

Jesse Livermore’s Trading Strategy and Its Impact

There is something special about Jesse Livermore’s trading strategy. It is not another method to trade stocks, but a philosophy that turned him into one of the greatest traders.

The Power of Price Movements and Market Timing

Livermore knew how to read price movements like no other at that time. He believed in timing the market rather than time in it and making big bets when he felt certain. Even though he was manifesting for going long on stocks, there were a few examples where he was short on markets. based on a hunch of the markets.

The Art of Buying Long Stocks

Buying long stocks, for most people, means betting on their rise over time. But Jesse didn’t see it as simple trading. For him, it was more like chess.

He would wait until a stock broke its previous high before buying. Seeing this as confirmation of a strong upward trend, an approach still relevant today.

Additionally, Jesse strongly supported using stop-loss techniques, which helped him to avoid big losses. He also made an effort to avoid letting his emotions guide his decisions because they were the main reason behind the highs and lows in both his trading and personal life.

Note: All strategies come with risks. Remember Jesse’s own words – “The game (stock trading) is…most hard for those who are trying to get rich quickly”. Wise advice from someone who had seen dizzying highs and crushing lows during his career on Wall Street.

The Highs and Lows of Jesse Livermore’s Trading Career

Jesse Livermore is a legendary trader, who experienced extreme highs and lows during his Wall Street career. He made big money but also faced average losses that led to multiple bankruptcies.

The Great Bear of Wall Street

Known as the “Great Bear of Wall Street”.

Livermore famously shorted stocks ahead of the 1907 Bankers’ Panic and made significant profits. On that specific day, he made $1 million ($30 million in today’s money). A statement to the power of understanding price patterns and perfecting market timing. This cemented his reputation as a street legend who could sense market shifts before they happened.

Despite his fame, Livermore did not always experience success. Even though he became one of the greatest traders in history, he often found himself losing money due to poor risk management strategies.

Backtesting of Jesse Livermore’s Strategy

In my mind, there were supposed to be many backtests on the internet of Jesse’s strategy. A place where you can find his strategy with specific rules written in code and ran through a specific time period.

Unfortunately, this is not the case.

Most of the blog posts that I researched are only sharing the methods that Jesse Livermore is using, but no one actually backtested it.

To my relief, I have found one person, who actually spent the time to do this and this person is Joe Marwood.

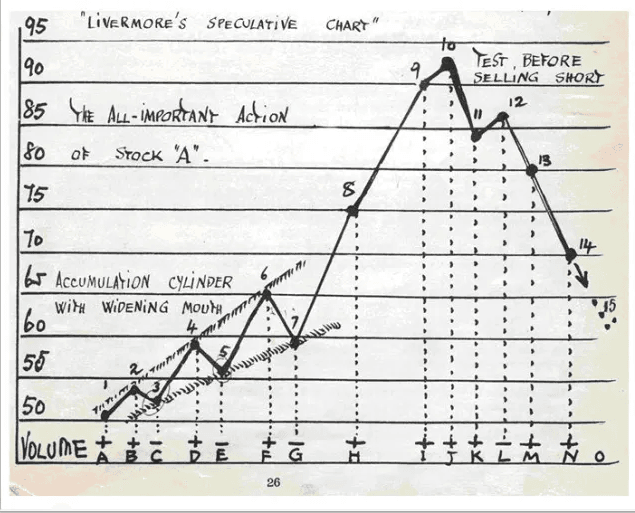

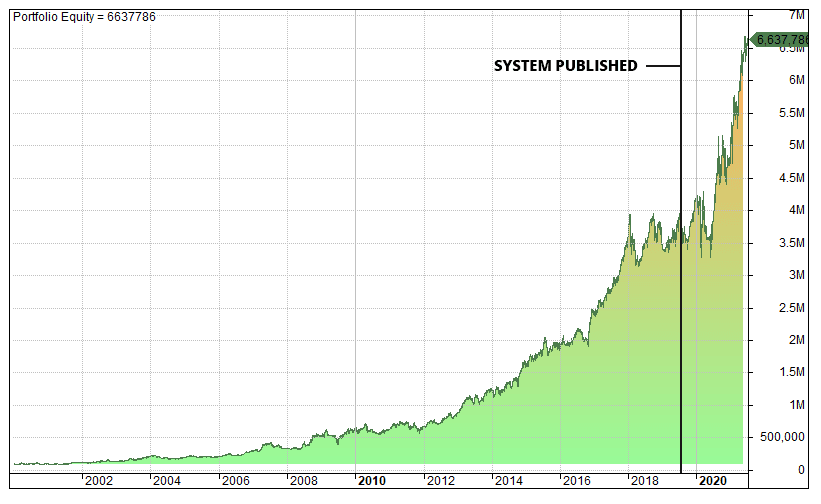

Joe Marwood has a great course dedicated to Jesse Livermore’s Strategy. There he explains some of the principles that Jesse is using in his trading and his philosophy about the markets. He explains in detail how to scan for trades, how to enter a position, what position size should be, and how to exit a trade based on Jesse’s strategy. Here are the results of that backtesting:

Joe Marwood has his own blog, where you can find a lot of valuable information that can help you improve your trading skills. You can visit it by clicking here.

The course itself you can find by visiting this link.

Livermore’s Bankruptcies and Losses

In contrast to these successes were moments where even this trading titan struggled. In fact, over his lifetime he declared bankruptcy multiple times.

This should remind you that every trade carries potential risks. No matter how good you are at reading price patterns or timing your positions right.

This cycle is something many traders today can relate to - chasing easy wins only to lose it all when luck runs out.

Yet despite such failures, we remember him for making what seemed like impossible bets work in an unpredictable stock market environment.

The Personal Life of Jesse Livermore

Jesse Livermore’s personal life was as volatile as his trading career. Known for being one of the greatest traders in history, he also had a turbulent personal life marked by multiple marriages and affairs.

Livermore married his first wife, Netit (Nettie) Jordan, at a young age. The couple had two sons but their relationship suffered due to Jesse’s constant involvement with the stock market. One thing led to another and they divorced after several years together.

He later married Dorothy Wendt who bore him another son. But despite all appearances of success, their marriage ended in divorce due to infidelity.

In 1934, due to various family issues and financial turmoil, he filed for bankruptcy for the second time.

This time Livermore made an unfortunate decision that shocked everyone around him. He committed suicide at Paine Webber’s office in NYC leaving behind an emotional note stating “My dear Nina: Can’t help it.” referring to his beloved third wife Harriet Metz Noble whom he called ‘Nina’.

Livermore amassed large fortunes from trading stocks throughout his lifetime. But they were matched equally by great losses. All these changes led to inferior emotional balance – leading to his tragic death.

FAQs in Relation to Jesse Livermore

What happened to Jesse Livermore?

Jesse Livermore, a famed trader, faced multiple ups and downs in his career. Despite making millions during the 1907 Bankers’ Panic and the 1929 stock market crash, he also experienced several bankruptcies. He took his own life in 1940.

How much money did Jesse Livermore make?

Livermore’s wealth fluctuated throughout his trading career due to repeated gains and losses. However, one of his most notable successes was earning $1 million in a single day at age 30 during the Panic of 1907.

How much was Jesse Livermore worth when he died?

The exact figure isn’t clear as financial circumstances changed frequently for him. At times in his life, though, it is believed that he accumulated fortunes of up to $100 million.

How did Jesse Livermore make $100 million dollars?

Livermore made this massive fortune by shorting stocks before significant market downturns like the Panic of 1907 and the Wall Street Crash of 1929 - timing these events based on price movements allowed him substantial profits.

Conclusion

The life and career of Jesse Livermore is really extraordinary. This Wall Street legend began his journey as the ‘Boy Plunger’ and became one of history’s greatest traders.

We dived into his unique trading strategy, based on price movements and market timing.

We tracked the peaks and troughs of his unsteady journey, ranging from making a million in one day to enduring multiple bankruptcies. Yet he persisted, even profiting during major market crashes.

The personal aspect was not left out. We explored Jesse’s turbulent private life filled with marriages, affairs, and family issues… A true testament that success often comes at a great cost!

Share

Quick Links

Legal Stuff

Social Media