Table Of Contents

I am looking at all these videos on YouTube and posts on the Internet that promise you success with different chart patterns. But I am wondering if there is a pattern that made someone rich by using some of these patterns.

Even though I have my preferences, It appears that there are a few that perform better than others.

The most popular one that we are going to talk about today is the “Cup and Handle” continuation pattern.

In this post, you are going to learn what the “Cup and Handle” chart pattern is, how to use it in your trading, and which famous traders are using this pattern.

So before I present to you why this is one of the most popular chart patterns, let’s see what actually “Cup and Handle” is all about.

William O’Neil developed this pattern back in 1988 and he shares it in his book “How to Make Money in Stocks”. This book is one of my personal favorites. From this book, you will find the best ways to trade stocks and I encourage you to read it at least once.

By this pattern name, you can see why it’s called like that. The pattern starts with bowl looking shape and by the end of the formation, a handle is formed. This gives you an entry point above the top of the handle part of the formation.

Cup and Handle Stages

It appears that you have to be careful with a few things when a “Cup and Handle” pattern is formed

- Duration: Cup patterns can last from 7 weeks to as long as 65 weeks, but most of them last for three to six months.

- Cup Depth: The usual correction from the absolute peak to the low point of this price pattern varies from around the 12 to 15 percent range to upwards of 33%

- Cup: In most, but not all, cases, the bottom part of the cup should be rounded and give the appearance of a “U” rather than a very narrow “V”. This characteristic allows the stock to proceed through a needed natural correction.

- Follow the trend: A strong price pattern of any type should always have a clear and definite price uptrend before the beginning of its base pattern.

- Handle: The handle part of this pattern is our key point to stepping into a trade. We have to wait for the price to break the top recent swing high of the handle and look around this point to start trading this formation.

Ok, but where to put my stop loss then, you are going to ask.

The stop loss should be under the last swing low and not more than 8% of the trade. I am saying no more than 8% because you need momentum so that this pattern would work. So if you do not have the momentum, then this pattern probably would fail and this 8% stop loss would protect you from losing a lot.

There are a few ideas behind this 8% stop loss and one of them is that if you have such a loss, probably you didn’t time the market properly. Just wait for new buy formation and try again to enter the market later.

The other reason for this specific stop-loss has its origins in the compounding effect. The greater the loss, the more gains would be needed to break even. So if you have a loss of 5% then you will need a gain of only 6% to break even. But if you lose 50% of your position then you have to make 100% in gain to break even.

You can see the difference, right?

Now you know what is “Cup and Handle” pattern, but probably you are asking yourself why should I bother? Why should I follow something from William O’Neil, who is he?

Who is William O’Neil?

William O’Neil is one of the most famous investors of all time and he is the inventor of the CAN SLIM strategy. This strategy generated a whopping 8400% return since the 2000s. Based on that we can clearly say that William O’Neil knows for sure what he is talking about.

He is not the only famous trader using this pattern.

Who is Mark Minervini?

Mark Minervini is another market wizard who generated huge wealth using the “Cup and Handle” pattern.

He started with only a few thousand dollars and turned them into millions and he averages 220% percent per year for over five consecutive years. For the same period, his compound return is an amazing 33 500%. To give you an example here, if you invested $10 000 with this return, you will end up with $3 000 000 in 5 years.

Mark Minervini also won the U.S. Investing Championship in 1997. Where he invested $250 000 of his money and won with a 155% return almost doubling his competitors’ returns.

Cup and Handle Examples

Now that you know why you should integrate this “Cup and Handle” chart pattern let me share with you a few examples of this pattern from William O’Neil’s book ”How to Make Money in Stocks“.

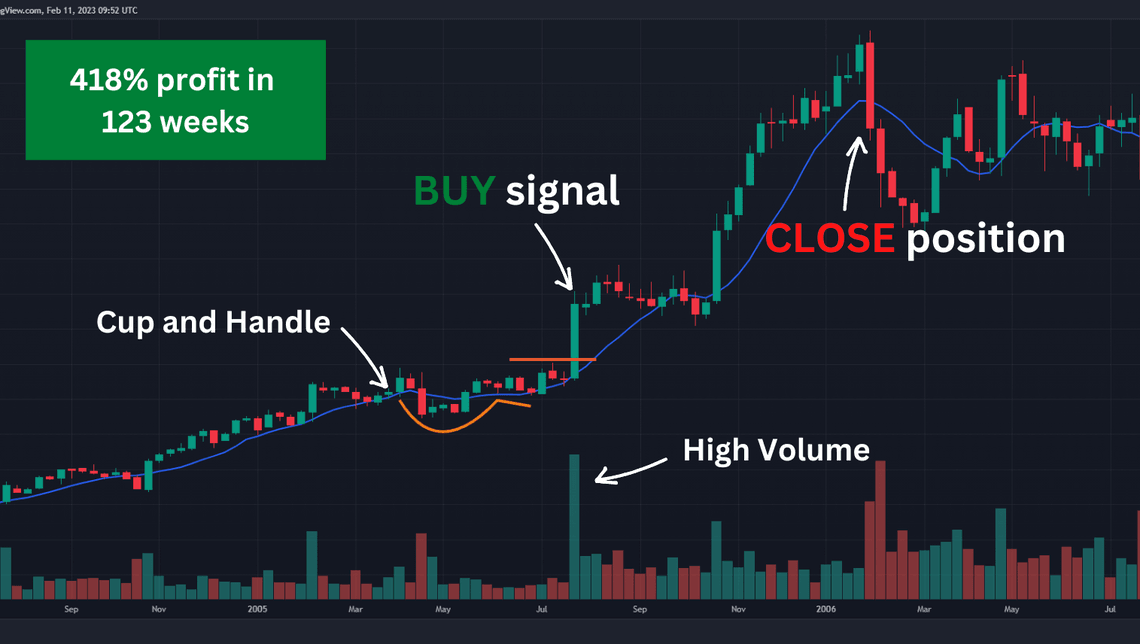

First Example

Let’s start with Intuitive Surgical or ISRG.

We are on the weekly chart of this stock and we can see that in April we have a “Cup and Handle” pattern to start forming. The base of this pattern is built till the end of May when we start the second stage of this pattern where it should form the handle.

You can see the final pattern at the end of June from where you can place your order above $17 per share and collect the whooping 418% after 123 weeks later.

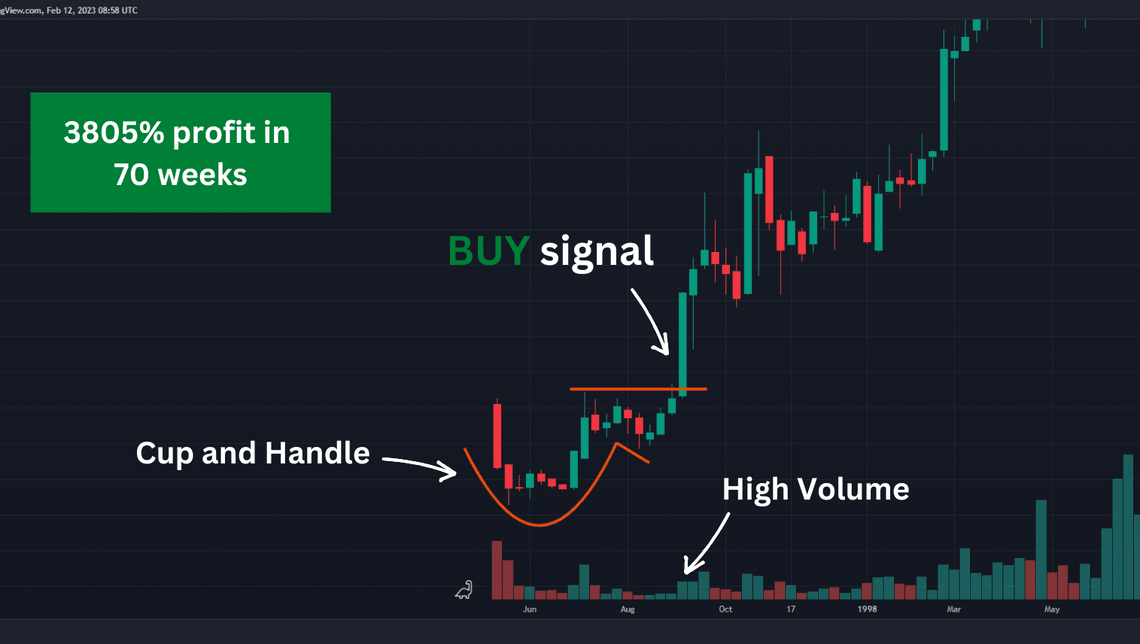

Second Example

Now we are on the weekly chart of Amazon and you can see that in June we have a “Cup and Handle” pattern. The pattern started to emerge in the middle of May and ends at the end of June. You could have placed your orders above $1.75 for an unreal profit of 3805% in 70 weeks later.

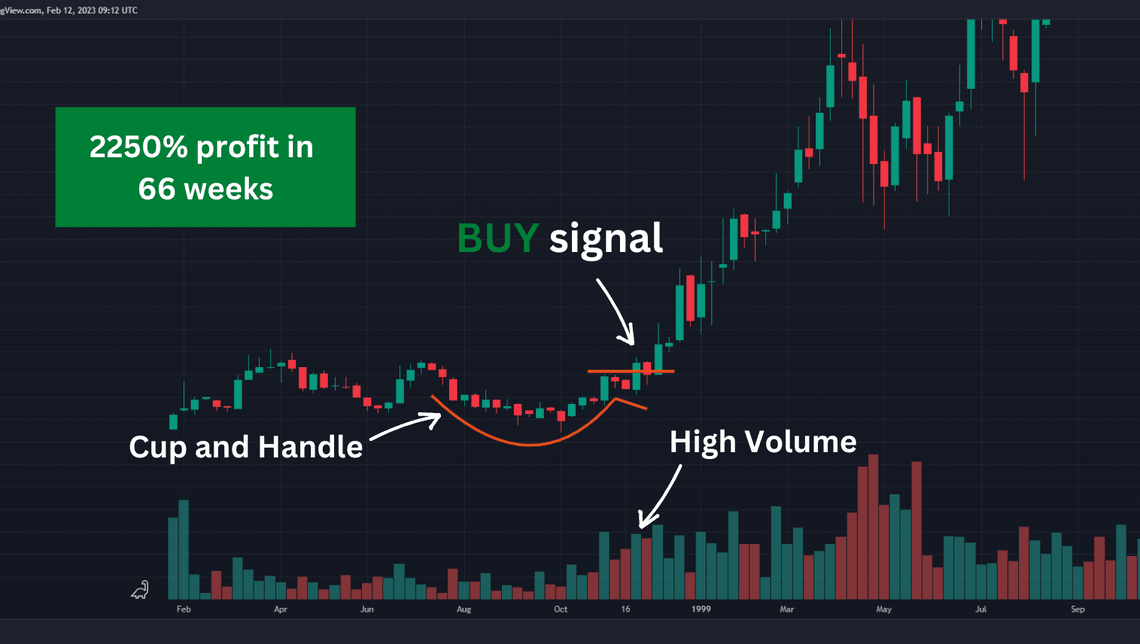

Third Example

The last example that you will see today is on the weekly chart of Verisign. It starts to form in July 1998 and it finishes in the middle of November. You could have placed your orders above $10 for an astonishing profit of 2250% in only 66 weeks.

Let me ask you a question here: Have you ever got 4 digit profit before?

Conclusion

Even though you see how well this “Cup and Handle” performed it does not mean that it’s a bulletproof strategy. You have to do your own research and see if this pattern actually fits your style of trading.

Also, keep in mind that you have to be in a confirmed trend to get the full benefit of this chart pattern. This is because it’s a confirmation pattern and not a reversal pattern.

Peter Brandt wrote in one of his books that patterns have no magical powers. Their only use is to give you a better risk-to-reward ratio and that’s all. So have that in mind with every chart pattern or indicator that you are going to use.

After we clear that, I will finish this post by saying that “Cup and Handle” is one of my favorite patterns out there and I regularly use it in my trading with pretty good results.

Share

Related Posts

Quick Links

Legal Stuff

Social Media